This Week in Beyond Wealth

Why FIRE goalposts keep moving

Public vs. private school debate

Benefits of PE secondaries

Merry Christmas and Happy Holidays! Let’s dive right in!

Money & Markets

How close am I to “enough”?

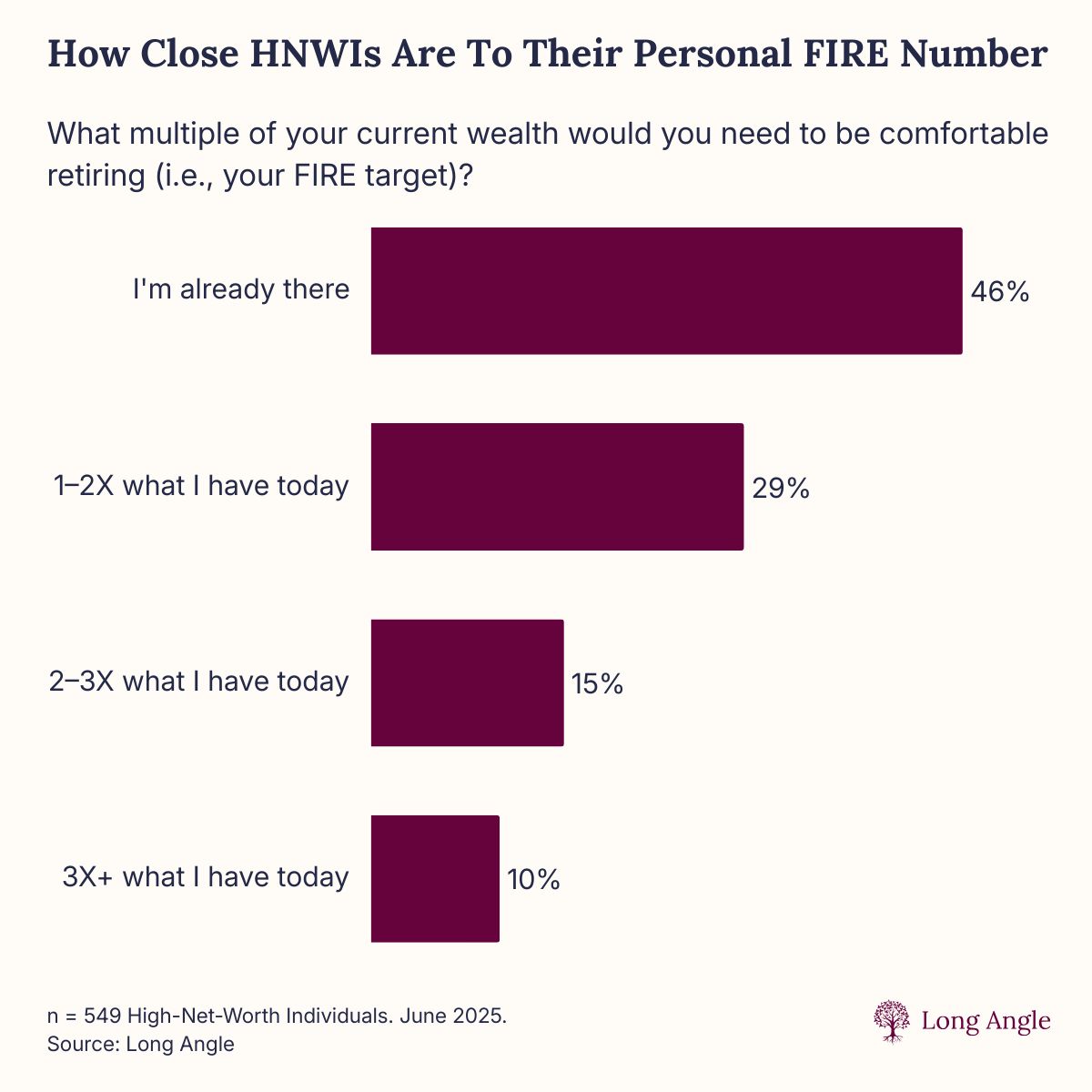

The FIRE movement (Financial Independence, Retire Early) is often framed as a numerical destination: accumulate enough assets to achieve financial freedom.

But as many discover, the closer one gets to “enough,” the blurrier it becomes.

A Long Angle poll shows that over half of HNW respondents say they still need additional multiples of their current wealth to feel comfortable retiring. And for many, the goalposts keep moving.

Long Angle members acknowledge that their FIRE numbers have doubled or tripled since they began tracking them, and there’s nothing wrong with that.

It’s rarely about endlessly chasing net worth. Instead, FIRE targets tend to stretch as priorities shift toward:

Insuring against uncertainty

Aligning wealth with purpose

Sustaining autonomy over the long term

What may appear to be a moving target from the outside often reflects a deeper recalibration of risk, meaning, and time.

For more on what retiring early really means for HNW peers, read FIRE Movement: How Much Is Enough to Retire Early?

Life, Health, & Family

Should I send my child to private school?

The public vs. private school decision is rarely straightforward for HNW parents.

Private schools may offer more personalized learning environments, while public schools can provide access to a wider range of backgrounds, perspectives, and experiences.

When we surveyed HNW parents with school-aged children, the split was nearly even.

For many families, access to top-tier public school districts makes the public option feel less like a compromise.

Among those who choose private school, satisfaction is strikingly high: over 90% report being satisfied or extremely satisfied. The top strengths cited by HNW parents include:

Excellent education

Sense of community

Small class sizes with individualized attention

But how do parents feel about the cost? High tuition is the most frequently cited “worst quality” of private schools, even among HNW families.

Yet satisfaction remains high despite the price tag, suggesting many view private education as a worthwhile investment.

Discover more insights on child care and education in the 2025 High-Net-Worth Professional Services Report.

Private Market Perspectives

What are the advantages of secondary funds?

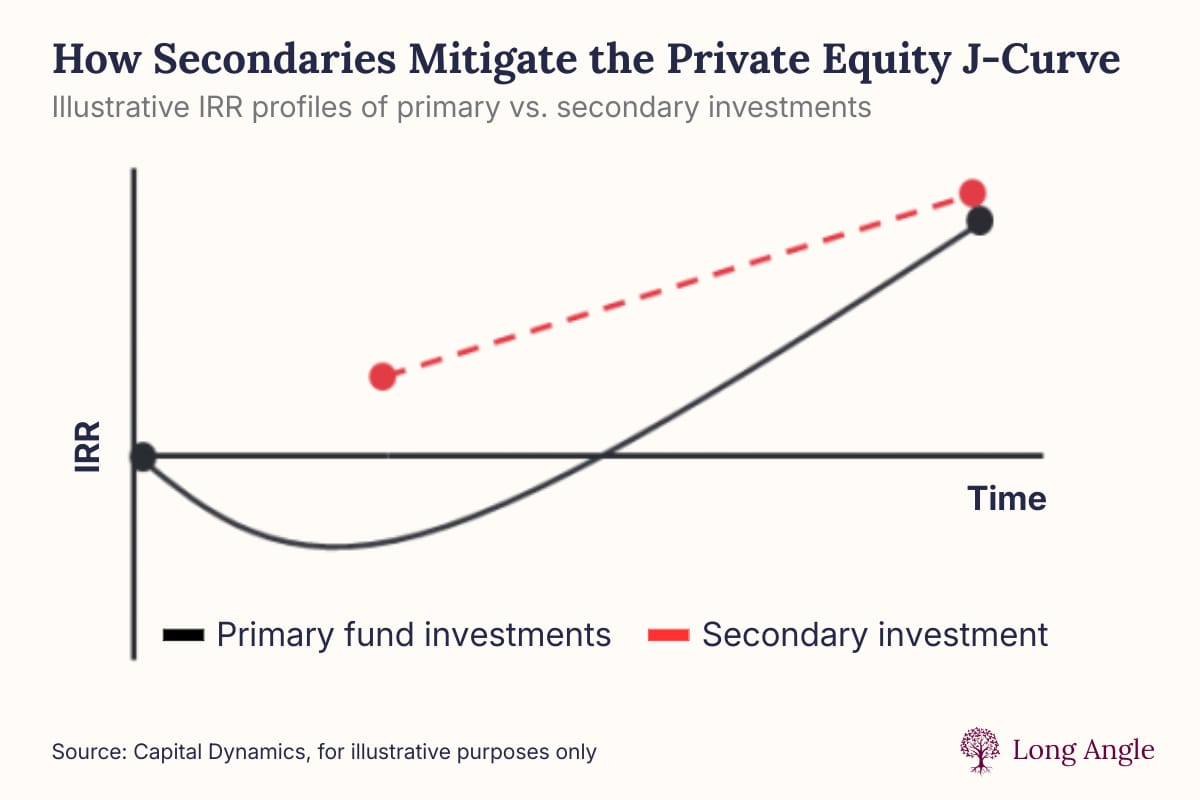

A secondary transaction is the transfer of existing interests in a private fund or asset to a new investor. Secondary funds have gained traction among HNW investors in 2025. One key reason:

With secondaries, investors can skip much of the early cash drag (the “J-curve”) that is common in traditional private equity before value creation begins.

Secondary investors often enter after a fund or asset has stabilized and entered a growth phase. With management already executing its strategy and assets appreciating, secondaries can generate positive IRRs relatively soon after investment.

Secondaries offer several additional advantages:

Potential discounts to NAV, which can create immediate upside

Reduced blind pool risk, since investors are buying into known assets

Built-in diversification across hundreds of companies, vintages, industries, geographies, managers, and strategies

Analyses from McKinsey & Company and PitchBook show that secondaries can deliver strong returns with tighter performance dispersion than other private market strategies.

Learn more about the pros and cons of secondary funds in Long Angle’s Secondaries Investment Guide 2025.

Around Long Angle

2026 Long Angle Member Retreat

Long Angle is excited to host our 2026 members-only retreat!

This is an exclusive event designed to foster collaboration, idea exchange, and personal growth among members. Attendees will experience:

Focused programming on financial and lifestyle topics

Deep dive discussions, retreat experiences, and workshops centered around Long Angle’s most popular topics

Connect with ~350 members from around the world at a 5-star resort

2026 Retreat Details:

Date: September 2026

Location: Hyatt Regency Lost Pines, Cedar Creek, Texas, USA

What’s included: lodging, meals and refreshments, all activities and experiences

Apply for Long Angle membership to learn more and reserve your spot! Save $500 with early registration, ending January 15th.

Published By

Chris Bendtsen

Insights Lead, Long Angle

Connect with me: LinkedIn | Learn more: Long Angle | Apply for free membership

Have thoughts? Reply to this email, I’d love to hear from you!

This material is for informational purposes only and is not investment advice regarding any security or investment strategy. Long Angle does not provide legal or tax advice, consult your attorney, CPA, or tax professional regarding your situation.

Long Angle Management, LLC (Long Angle), is an SEC registered investment adviser firm. Registration does not imply a certain level of skill or endorsement. Investing involves risk, including potential loss of principal. Past performance is not indicative of future results.