This Week in Beyond Wealth

Why CPA loyalty is fading

Non-employer health insurance for HNWIs

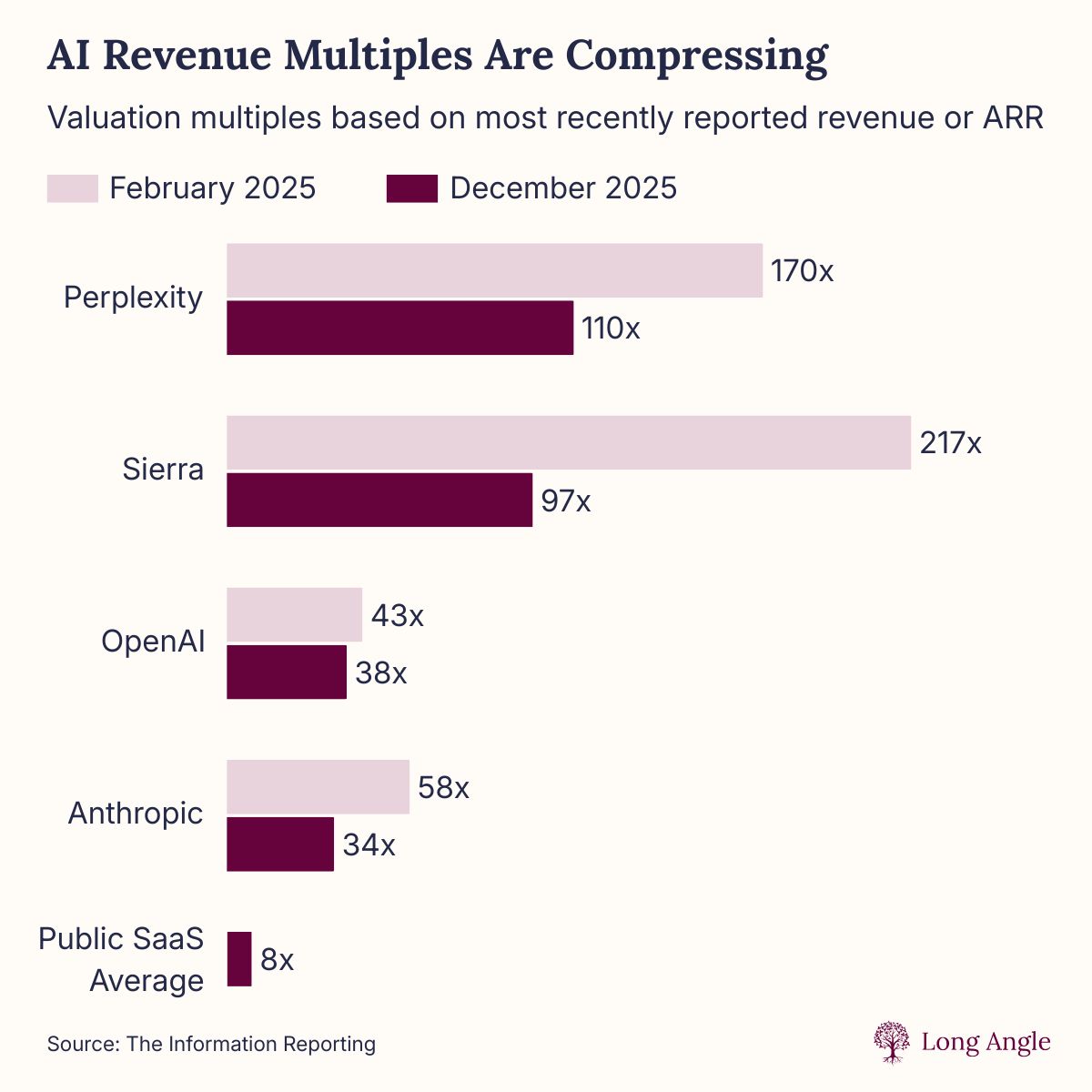

AI revenue multiples show signs of gravity

Money & Markets

Is it time for a new CPA?

Having a CPA is nearly universal among HNW households. 82% of Long Angle members use one.

But loyalty is fading. Four in ten HNW clients are considering a switch.

Why the dissatisfaction? In a recent episode of the Navigating Wealth Podcast, our hosts pointed to opaque and fragmented pricing, unclear scopes of service, and fees that feel misaligned with value delivered.

Many HNW clients told us they’re frustrated that their CPAs aren’t strategic or proactive.

In contrast, Long Angle members who report the highest CPA satisfaction receive strategic guidance, not just filings before the deadline.

That kind of tax strategy typically includes:

Scenario-based planning to time income, deductions, and capital gains

Charitable strategies like donor-advised funds or donating appreciated assets to avoid capital gains

Business owner tax efficiency through entity structure and owner compensation planning.

For more insights, read Long Angle’s High-Net-Worth Professional Services Report.

Life, Health, & Family

What are my options for non-employer health insurance?

Leaving employer-sponsored health insurance can be complicated for high-net-worth households.

The assumption that “wealthy people just pay out of pocket” doesn’t reflect reality. So what are the options?

Many affluent families start with a private health insurance broker who can compare off-exchange PPOs, national networks, and international plans with far more guidance than a typical marketplace experience.

Other options include concierge medicine or Direct Primary Care (DPC). Instead of billing insurance, these models charge a flat monthly or annual fee for enhanced benefits like same day appointments and longer visits.

In practice, Long Angle members told us they combine approaches: a traditional insurance plan for major medical events paired with concierge or DPC for day-to-day care.

Some members with $20M+ net worth choose to self insure for routine care and only maintain catastrophic policies.

Our blog post, Non-Employer Health Insurance: A Strategic Guide for High-Net-Worth Households, gives a much deeper dive into these options and more.

Private Market Perspectives

What do AI startup valuations say about the market?

Market commentary by Min Park, Long Angle’s Chief Investment Officer

Revenue multiples for most AI startups have finally dropped in recent financings, albeit moderately.

Part of this is simple math: revenues are accelerating faster than valuations, leading multiples to trend downwards. But the data may foretell some other interesting trends here.

Slowly inching towards the "show me" phase: While hype and momentum still exist, increased scrutiny in public markets is likely translating to privates as investors expect real growth and unit economics.

AI stack spread: Multiples for model developers dropped more than that of AI apps. This is a function of the ecosystem maturing and a reflection of where VCs see future value creation across the AI stack.

Infrastructure re-rating: Generalized model performance is converging with switching costs arguably low. Valuations for model developers may re-rate downward as they look more like utilities (with the exception of OpenAI and Anthropic).

Long Angle members can reach out to the Long Angle Investments team with any questions on AI revenue multiples or the state of public and private markets.

Around Long Angle

Music Royalties Investment Opportunity

Long Angle is excited to offer its members an investment opportunity in a leading music royalties platform that is partnered with one of the largest music companies in the industry.

This opportunity offers unique access to a defensive, non-correlated asset in music royalties within a highly tax-efficient structure.

The investment is designed to provide steady yield through quarterly dividends, with target returns reflecting private credit downside with equity upside. Long Angle members can reach out to the Long Angle Investments team for more details.

Interested in investing but not a member yet? Apply for free Long Angle membership here.

To learn more about the asset class, read our Music Royalties Investment Guide 2025.

Published By

Chris Bendtsen

Insights Lead, Long Angle

Connect with me: LinkedIn | Learn more: Long Angle | Apply for free membership

Have thoughts? Reply to this email, I’d love to hear from you!

This material is for informational purposes only and is not investment advice regarding any security or investment strategy. Long Angle does not provide legal or tax advice, consult your attorney, CPA, or tax professional regarding your situation.

Long Angle Management, LLC (Long Angle), is an SEC registered investment adviser firm. Registration does not imply a certain level of skill or endorsement. Investing involves risk, including potential loss of principal. Past performance is not indicative of future results.