This Week in Beyond Wealth

HNW investors’ S&P 500 predictions

Nanny vs. day care costs

How to think about private markets

Money & Markets

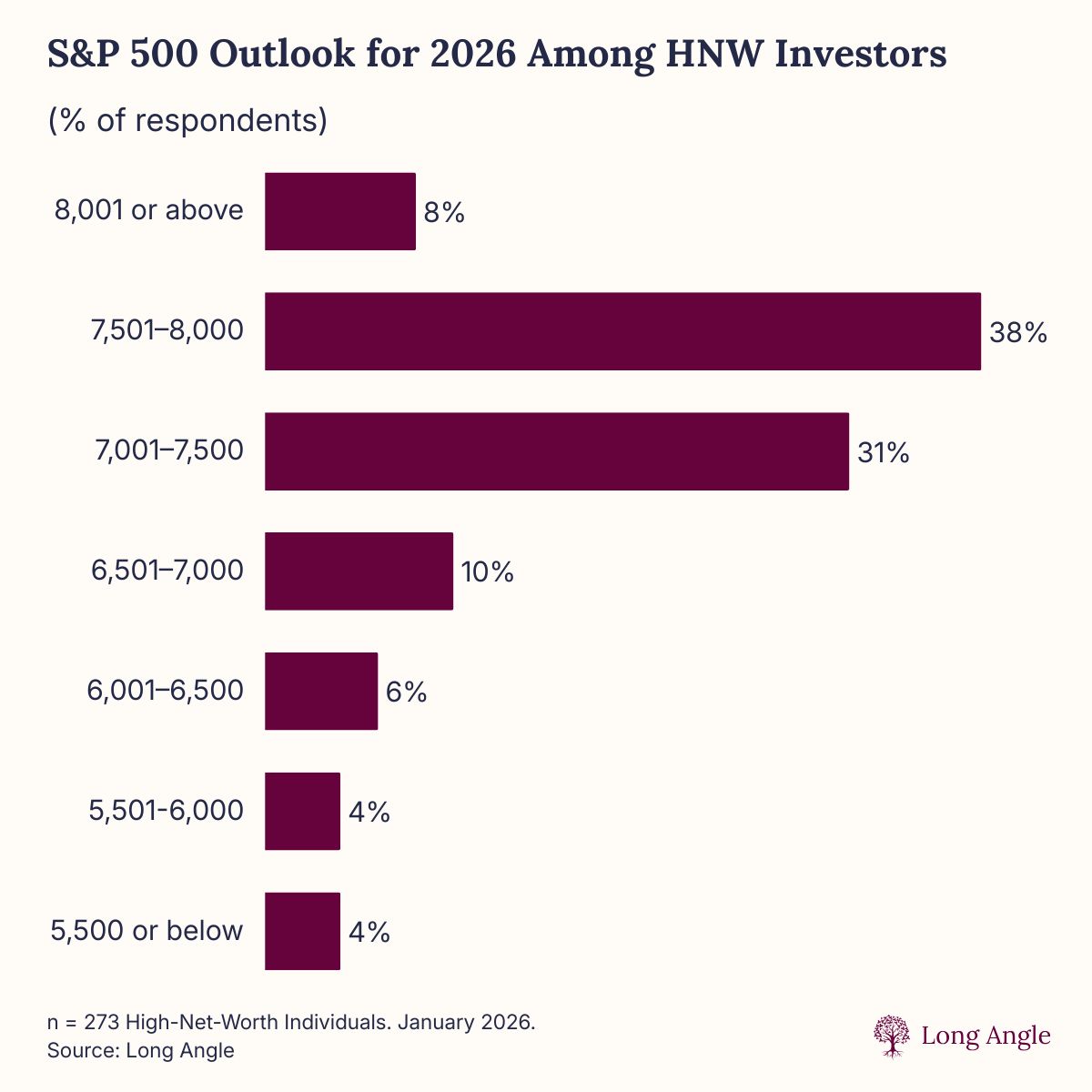

Where do other investors see the S&P 500 moving in 2026?

Nobody can predict the stock market. With that said, we ran a poll to see what HNW investors are thinking anyway.

We asked Long Angle members where they expect the S&P 500 to close at the end of 2026. For context, it ended 2025 at 6,845.50.

The results show optimism: 77% of respondents predict a year-end gain. The most popular answer, chosen by well over a third of members, points to a moderate gain closing between 7,501 and 8,000. That equates to 10%–17% year-over-year growth.

Few foresee a correction or bear market. In our member discussion, some tied a potential pullback to AI hype, while others pointed to strong GDP growth, cooling inflation, and improving deficit metrics as reasons we remain in a secular bull market.

Our members called it in last year’s poll with the most popular answer of 6,501–7,000 (a moderate gain). We’ll see if the Long Angle community gets it right again.

Life, Health, & Family

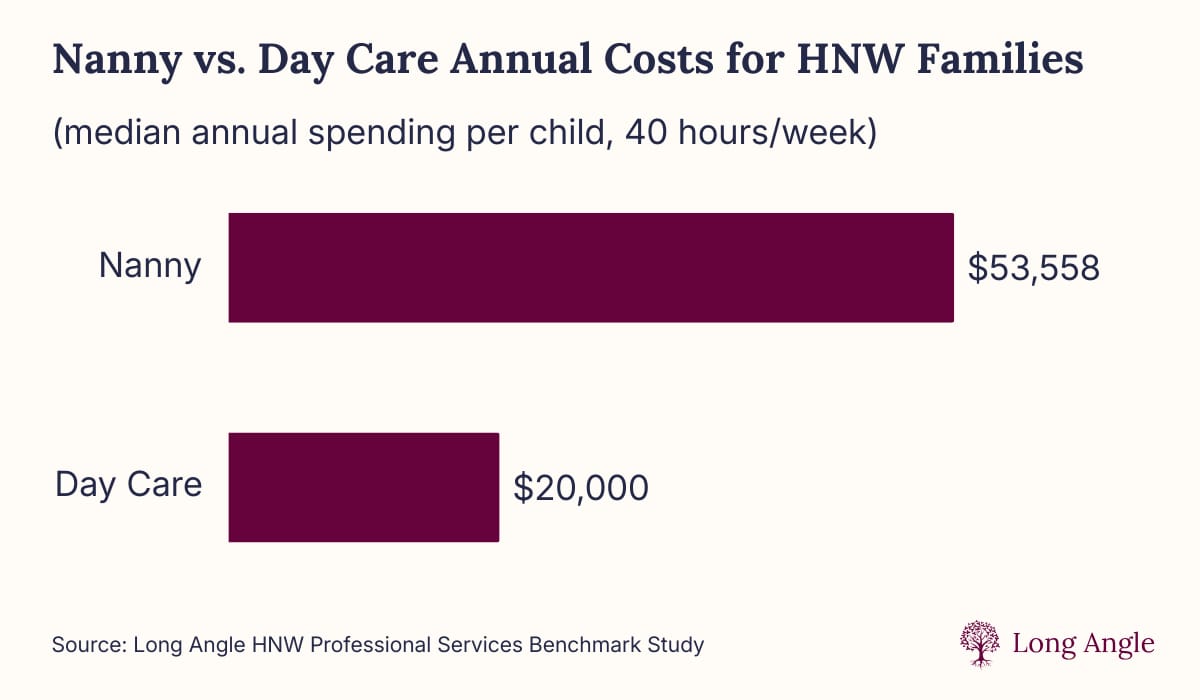

How do nanny and day care costs compare for HNW families?

Child care decisions aren’t always straightforward, and even HNW families evaluate costs when comparing options.

A Long Angle survey reveals that nannies cost about 2.5x more than day care. The median cost for one child at 40 hours a week is roughly $50K per year for a nanny, compared to $20K for day care.

Despite the steep price, cost isn’t a top complaint among families with nannies. When describing what they value most, parents emphasize reliability and trust as their nanny’s best traits, suggesting higher costs are justified by the personalized care a nanny provides.

Nannies are the more common choice, used by 42% of HNW families with children ages 0–12, compared to 33% who rely on day care.

Download our High-Net-Worth Professional Services Report for more insights on how wealthy peers use, spend on, and evaluate professional services.

Private Market Perspectives

What are the basics of private market investing?

Commentary from Min Park, Chief Investment Officer at Long Angle.

Private markets span a wide range of strategies that can often feel overwhelming, especially for investors just getting started. A simple framework can help guide allocations.

At the foundation are core strategies: yield-focused investments like private credit and core real assets (e.g., stabilized real estate, infrastructure). These aim to provide steady income, lower volatility, and capital preservation, typically targeting mid- to high-single-digit returns.

From there, investors can add complements, such as junior credit and non-core real assets like specialty real estate. These carry more risk but add diversification and mid-teens return potential.

At the top sit return enhancers: growth-oriented strategies like private equity buyouts and venture capital. These target higher returns, often 15% to 30% or more, but come with meaningful risk.

This layered approach to private markets can help balance income, growth, and risk. To learn more, watch the replay of Long Angle’s recent webinar with Alto, Investing Beyond the 60/40 Portfolio.

Around Long Angle

Evergreen Private Equity

Long Angle’s Evergreen Fund Investment Guide is a comprehensive introduction to private market evergreen funds. The guide defines the different types of evergreen investment vehicles, outlines key benefits for investors, and explains how to evaluate sponsors. It also clarifies common terminology and highlights performance characteristics to help readers more confidently evaluate if evergreen funds are a fit for their portfolio.

To learn more about evergreen strategies, read the complete guide here.

Interested in Long Angle Investments but not a member yet? Apply for free Long Angle membership here.

Published By

Chris Bendtsen

Insights Lead, Long Angle

Connect with me: LinkedIn | Learn more: Long Angle | Apply for free membership

Have thoughts? Reply to this email, I’d love to hear from you!

This material is for informational purposes only and is not investment advice regarding any security or investment strategy. Long Angle does not provide legal or tax advice, consult your attorney, CPA, or tax professional regarding your situation.

Long Angle Management, LLC (Long Angle), is an SEC registered investment adviser firm. Registration does not imply a certain level of skill or endorsement. Investing involves risk, including potential loss of principal. Past performance is not indicative of future results.