This Week in Beyond Wealth

Top HNW financial objectives

Transferring wealth responsibly

How peers invest in private companies

Happy New Year! Let’s dive right in!

Money & Markets

What is my primary financial objective?

For many HNW individuals, wealth is just a means to the lifestyle they want.

We asked over 300 Long Angle members about their primary financial objective. In other words: the “why” behind wealth.

Nearly half chose “lifestyle and flexibility.” This could mean frequent travel, multiple homes, access to premium products and services, or time to focus on family and personal passions.

Financial independence, retire early (FIRE) ranked second at 33% of HNW respondents. While linked to lifestyle, FIRE represents a more defined milestone of retirement. That said, many pursue FIRE while continuing selective work, entrepreneurship, or passion projects rather than fully stepping away.

Security was selected by just 10%, likely because basic stability is already in place for affluent households. Legacy and philanthropy drew an even smaller share, reflecting priorities that tend to grow with age.

For more discussions like this, check out our HNW Insights Blog.

Life, Health, & Family

How do I plan for transferring wealth?

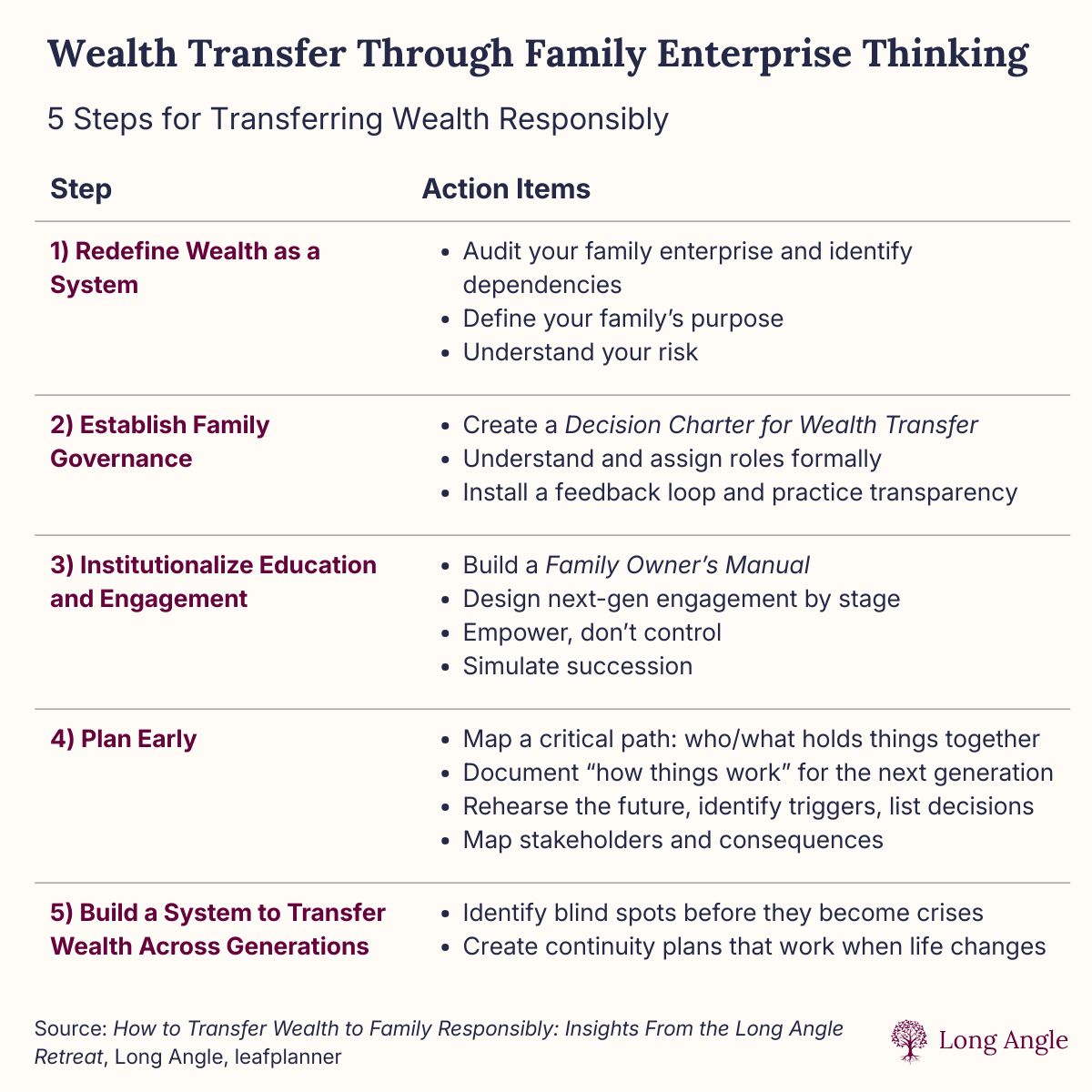

If you’re thinking about passing wealth to the next generation and don’t know where to start, consider Family Enterprise Thinking.

Redefine wealth as a system: Families that thrive across generations treat themselves as a living system. A family’s financial capital can be used to grow and support the family’s other capitals: its legacy, social, intellectual, and human capital.

Establish governance: Family enterprise governance is the process by which families make decisions together across generations. Start by creating a decision charter for wealth transfer that outlines decision-making. Make sure to formally assign roles (e.g., executor, trustee, beneficiary, investment lead).

Educate and engage heirs: Families often mistake financial literacy for readiness. Real preparedness is understanding how the family enterprise operates and where heirs fit within it. Consider building a family owner’s manual to prepare children for receiving wealth.

For a complete breakdown of Family Enterprise Thinking, read How to Transfer Wealth to Family Responsibly: Insights From the Long Angle Retreat.

Private Market Perspectives

How are my peers investing in private companies?

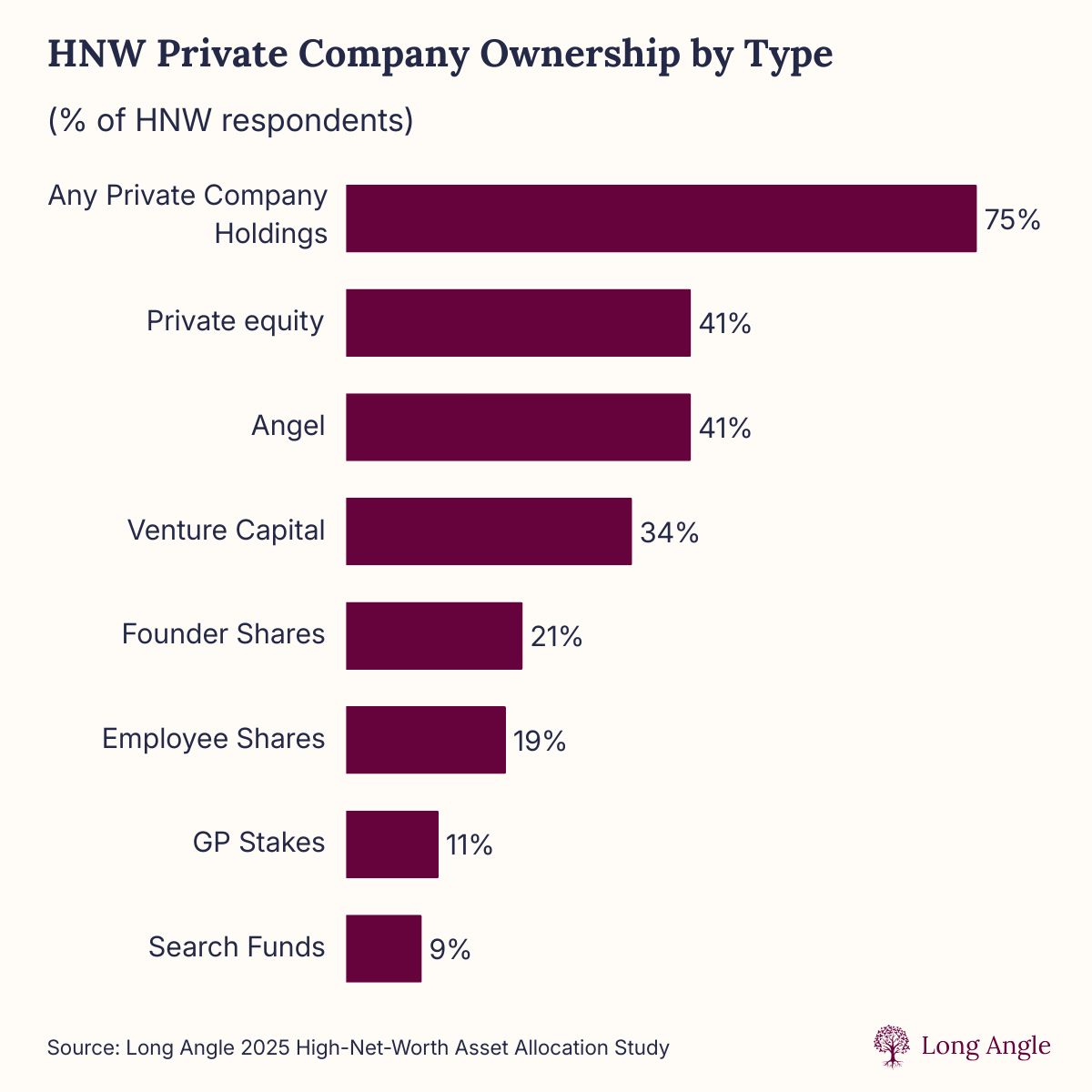

Private company ownership has moved firmly into the mainstream for high-net-worth investors. In a 2025 Long Angle survey, 75% of respondents reported owning private company holdings.

Private equity and angel investments are the most common entry points, each held by roughly four in ten respondents. Venture capital is next at 34%, followed by direct founder shares and employee equity. More specialized exposures, such as GP stakes and search funds, remain less common today but are gaining traction as investor education and access continue to improve.

Private company ownership rises meaningfully with net worth. About half of investors with $2–$5M have private company holdings, climbing to 62% for $5–$10M households and over 80% for those with more than $10M.

Private equity dominates ownership across the $2–$10M range, while angel investing becomes most prevalent at $10M+ wealth levels.

Read Long Angle’s 2025 High-Net-Worth Asset Allocation Report for deeper insights, and watch for the 2026 edition coming soon.

Around Long Angle

Starting the year with Long Angle

Join over 6,500 vetted members in Long Angle’s trusted high-net-worth peer community and make 2026 a year of meaningful connections.

Engage with members in online discussions covering everything from portfolio strategy and tax planning to family wealth, travel, and lifestyle.

Join meaningful conversations, exchange ideas, and learn from peers who face the same challenges and opportunities.

Visit our website to learn more and apply for free Long Angle membership today.

Published By

Chris Bendtsen

Insights Lead, Long Angle

Connect with me: LinkedIn | Learn more: Long Angle | Apply for free membership

Have thoughts? Reply to this email, I’d love to hear from you!

This material is for informational purposes only and is not investment advice regarding any security or investment strategy. Long Angle does not provide legal or tax advice, consult your attorney, CPA, or tax professional regarding your situation.

Long Angle Management, LLC (Long Angle), is an SEC registered investment adviser firm. Registration does not imply a certain level of skill or endorsement. Investing involves risk, including potential loss of principal. Past performance is not indicative of future results.