This Week in Beyond Wealth

What HNW individuals want to learn

Gas, electric, and hybrid car ownership

How family offices invest

Money & Markets

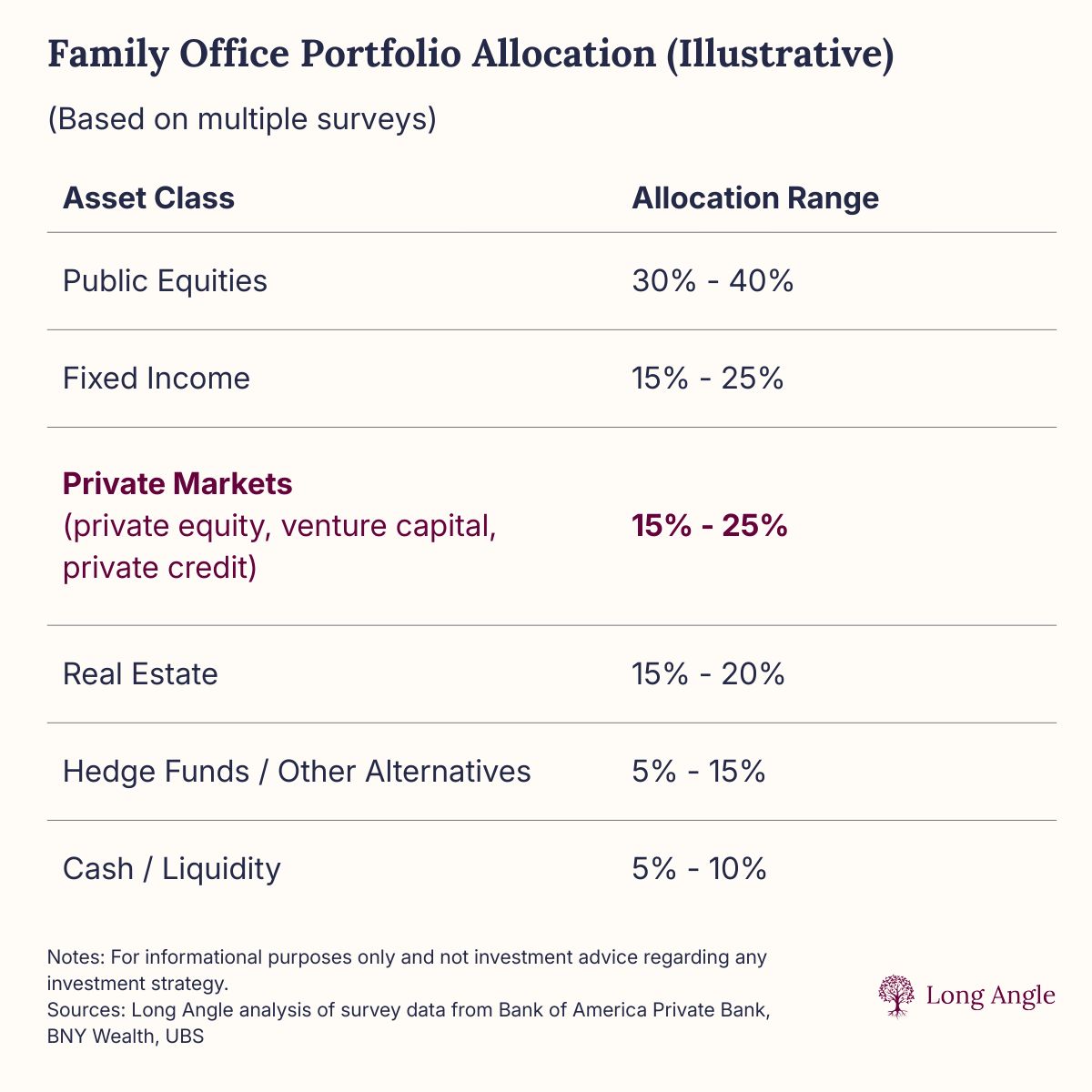

What financial topics do I wish I knew more about?

Have you ever thought about which financial (or non-financial) topics you’d most benefit from learning more about?

We polled roughly 200 HNW individuals on areas where they’d like more education, and the top answer was the one domain no one can avoid: taxes.

Effective tax strategy often begins with the right expertise. Advanced planning with an experienced CPA can involve scenario-based analysis, entity structuring for business owners, and charitable strategies to minimize capital gains.

The second most requested topic was estate planning. While setting up a will may be straightforward, many HNW plans involve revocable and irrevocable trusts that add layers of complexity.

Both investing categories ranked highly, highlighting the desire for better-informed portfolio management. Non-financial learning in areas like travel and health & fitness is also in demand, showing that these decisions benefit just as much from thoughtful planning as financial ones.

We’ll be producing educational whitepapers and videos throughout the year on many of these topics as part of the Long Angle membership experience.

Life, Health, & Family

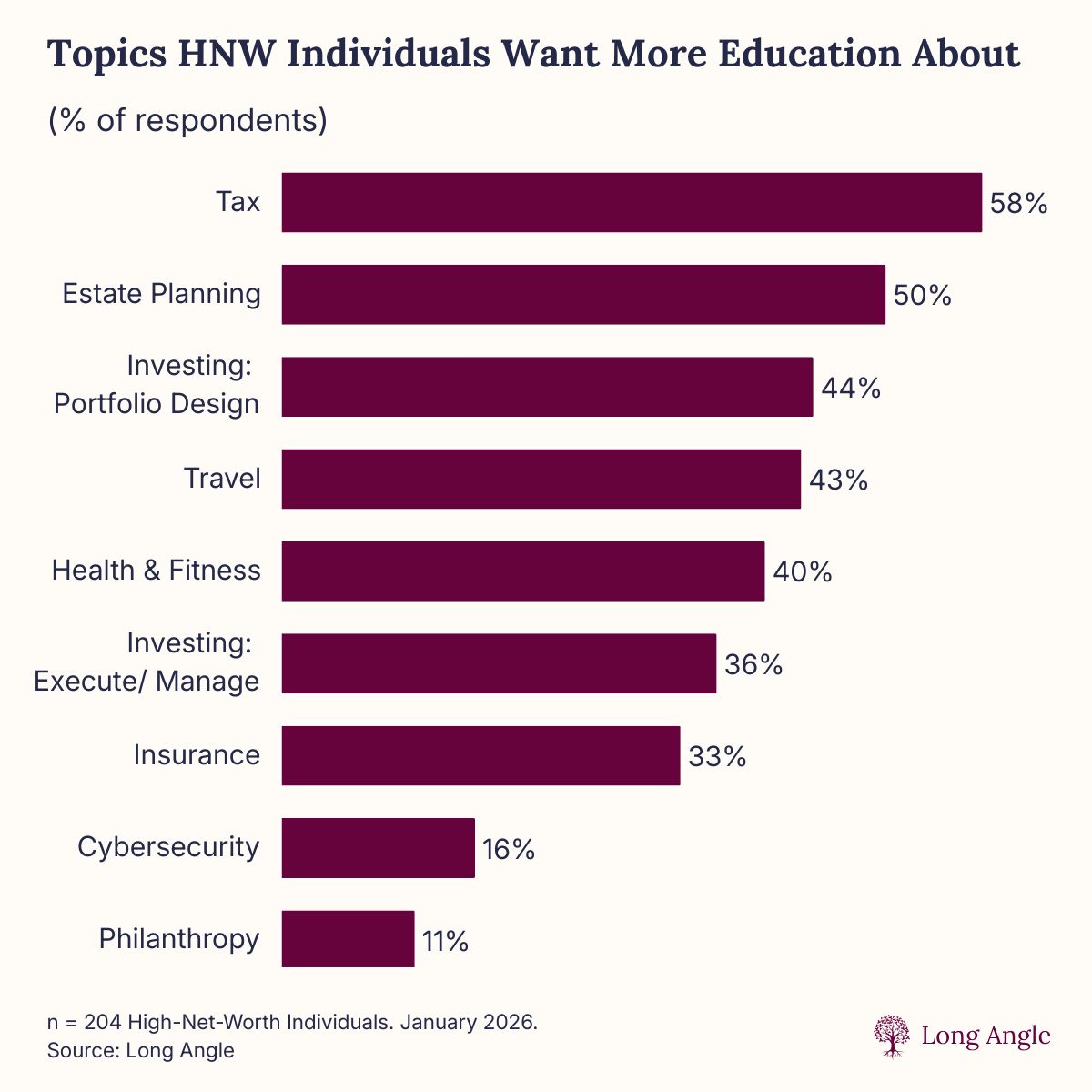

What kind of cars are my peers driving?

Gas and electric vehicles are in a close race for wealthy drivers. We asked over 500 Long Angle members in one of our most participated polls what kind of cars they own or lease.

The results were close: Gas 53%, Electric Vehicle 46%.

Almost half of HNW individuals are now driving electric. Popular reasons include environmental impact, the convenience of skipping gas stations, and potential tax incentives for EV purchases.

In our Long Angle member discussion, many passionately shared what EVs they drive. Tesla was the most common by far, with others including Rivian, Porsche Macan EV, and Chevy Bolt.

When asked about price levels, the most common answer was mid-tier luxury ($55K–$99K), selected by just over half of respondents.

Hybrid adoption is low, suggesting that many drivers prefer to go “all in” on electric. Several members even said they’ll never go back to gas.

Private Market Perspectives

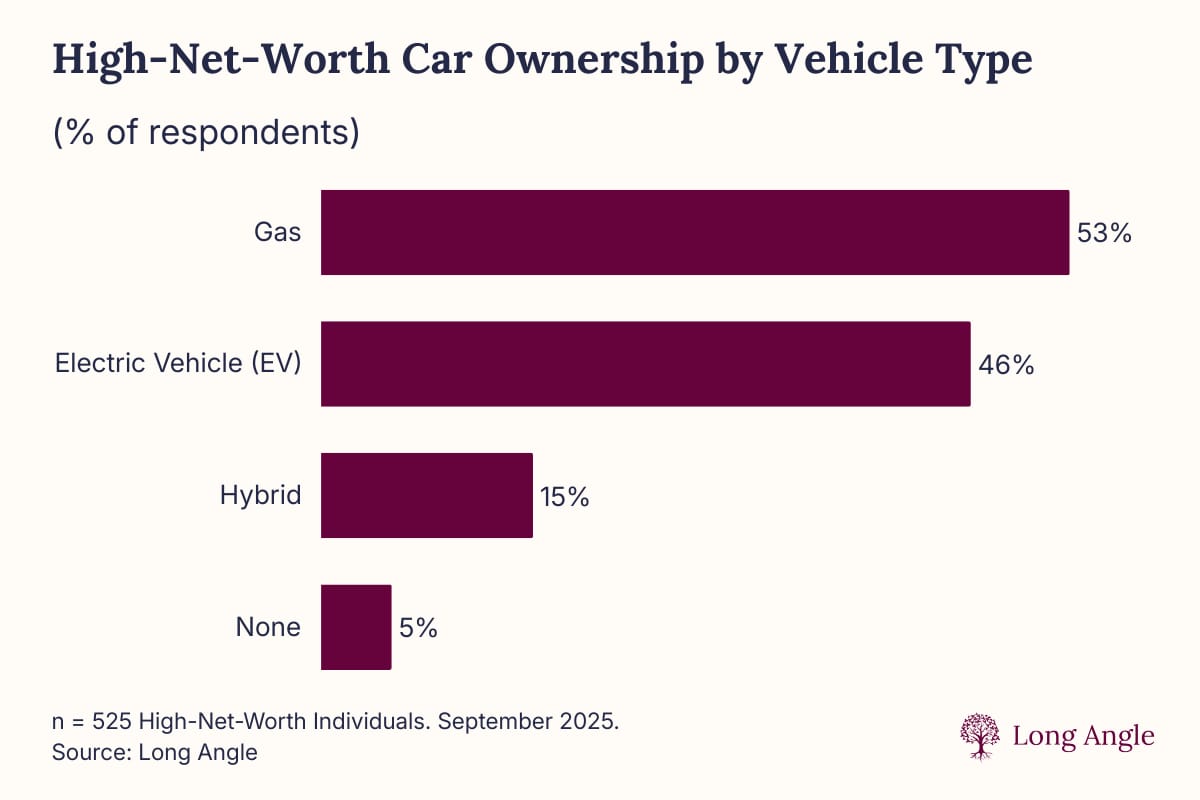

How do family office investments differ from mine?

Family offices are evolving to be more like institutional investment platforms. Survey data from UBS, bfinance, and other studies show private markets becoming a core component of many family office portfolios.

Across multiple surveys, respondents reported maintaining or increasing allocations to:

Private equity and venture capital

Private credit and direct lending

Real estate as a core income and diversification pillar

Developed‑market fixed income

Below is an illustrative example of a family office portfolio based on reported survey ranges:

Actual allocations can vary widely based on factors such as family wealth level, operating business exposure, geography, and risk tolerance. That said, meaningful diversification in private markets is a common theme.

For HNW investors, this framework can serve as a reference point. Evaluate which differences in your own portfolio may warrant reconsideration given liquidity needs, time horizon, risk profile, and deal access.

For a deeper look at how family offices approach investment strategy and risk, see our blog article, Family Office Trends 2025.

Around Long Angle

Trusted Circles: Your Personal Board of Directors

Many HNW individuals treat their personal wealth as a series of disconnected transactions rather than a cohesive system. You ask a lawyer about a trust. You ask a friend for a stock tip. But who is looking at the complete picture besides you?

You wouldn’t run a company without a board. You shouldn't run your life without one, either.

A Long Angle Trusted Circle is a high-net-worth peer advisory group where members come together to navigate life's challenges and opportunities, fostering growth through shared experience and perspective.

Monthly peer meetings focus on:

Pressure testing: validate your thinking on investments before committing capital

Vendor vetting: learn from members who have firsthand experience with estate attorneys and other advisors

Strategic alignment: ensure your financial decisions reflect your life goals and family values

Get Started: Learn more about Trusted Circles.

Published By

Chris Bendtsen

Insights Lead, Long Angle

Connect with me: LinkedIn | Learn more: Long Angle | Apply for free membership

Have thoughts? Reply to this email, I’d love to hear from you!

This material is for informational purposes only and is not investment advice regarding any security or investment strategy. Long Angle does not provide legal or tax advice, consult your attorney, CPA, or tax professional regarding your situation.

Long Angle Management, LLC (Long Angle), is an SEC registered investment adviser firm. Registration does not imply a certain level of skill or endorsement. Investing involves risk, including potential loss of principal. Past performance is not indicative of future results.