This Week in Beyond Wealth

How HNW peers think about concentrated stock positions

2026 New Year’s resolution themes

Long Angle Investments: 2025 year in review

Money & Markets

How much concentration in a single stock am I comfortable with?

An investor’s sleep number is the maximum percentage of a portfolio you’re comfortable concentrating in a single stock and can still sleep at night. The term was coined by David Gardner, co-founder of The Motley Fool.

We polled nearly 300 HNW individuals and most said their sleep number is below 15%.

More than a quarter said their sleep number is under 5%, likely reflecting a preference for broad diversification, often through index funds (e.g., Bogleheads). The largest group (33%) landed between 5% and 15%, with several noting they trim positions once they grow beyond this range.

At the furthest end of the spectrum, some founders and startup employees said they’re completely comfortable holding 50% to 90%+ concentrations.

While everyone’s sleep number is different, one theme stood out across our discussion: high concentrations can make sense when you’re investing in the right company.

Listen to the Navigating Wealth Podcast to hear our hosts discuss the sleep number concept with David Gardner, in How to Evaluate Stocks to Achieve Market-Beating Returns.

Life, Health, & Family

What are my 2026 New Year’s resolution themes?

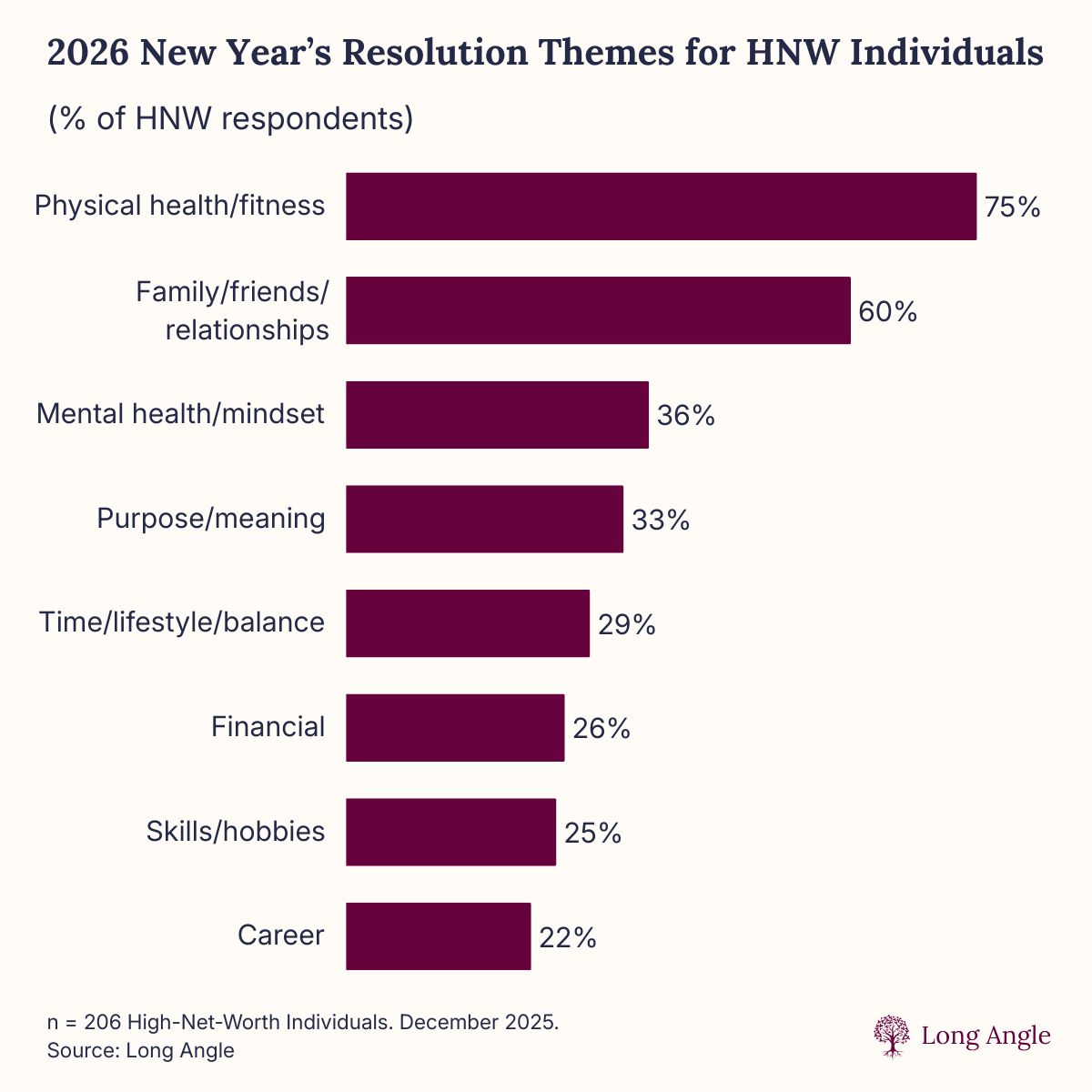

The start of a new year is a natural moment to reflect on what matters most. We asked Long Angle’s HNW members what their 2026 New Year’s resolutions are focused on.

Physical health and fitness topped the list, with 75% including it in their resolutions. Family, friends, and relationships came next, highlighting a desire to maintain and strengthen connections. Some members said they’re specifically prioritizing in-person socialization this year.

Mental health and mindset, purpose and meaning, and time, lifestyle, and balance were each chosen by about a third of respondents. Together, they reflect a broader emphasis on quality of life and intentional living.

Financial and career goals were less prominent themes, suggesting many are focusing more on life outside of work. Skills and hobbies were chosen by only a quarter of respondents, indicating many HNW peers are instead channeling their free time into health and relationships.

Join Long Angle to participate in weekly polls and discussions like this.

Private Market Perspectives

Long Angle Investments Year in Review

A message from Matt Shechtman, CEO of Long Angle Management.

We had quite a year here at Long Angle Investments with consistent growth and more new Long Angle members investing than in any prior year. This has enabled us to significantly build out the team to better serve investors while simultaneously accessing some of the best managers globally through larger commitment sizes. Here are some key stats for 2025:

$175M raised

1,360 new subscriptions and 510 unique members

$8.6M distributed back to members

20 new SPVs across 12 primary investments, 5 low or no-fee co-invests, and 3 offshore blockers

That brings our all-time milestones to:

We were excited to establish new partnerships with so many world-class managers this year. Thank you to the amazing teams we worked with at KKR, H.I.G. Capital, Lightspeed, Realterm, 10 Federal, Speyside Capital, StepStone Group, Lead Edge Capital, Bonaccord Capital Partners, Peterson Search, and Encore Capital, among others.

Looking forward to a great 2026! Visit our website to learn more about how to gain access to institutional-grade alternative investments with Long Angle.

Around Long Angle

January Member Events

Long Angle members can access a wide range of high-net-worth events and workshops throughout the year designed to help you navigate wealth.

Here’s our member event calendar for January 2026:

Apply for free Long Angle membership today to participate!

Published By

Chris Bendtsen

Insights Lead, Long Angle

Connect with me: LinkedIn | Learn more: Long Angle | Apply for free membership

Have thoughts? Reply to this email, I’d love to hear from you!

This material is for informational purposes only and is not investment advice regarding any security or investment strategy. Long Angle does not provide legal or tax advice, consult your attorney, CPA, or tax professional regarding your situation.

Long Angle Management, LLC (Long Angle), is an SEC registered investment adviser firm. Registration does not imply a certain level of skill or endorsement. Investing involves risk, including potential loss of principal. Past performance is not indicative of future results.